Expanding Real Estate ROI With 1031 Exchanges

Property owners and real estate investors—and their advisors—have a lot to gain by diving into 1031 exchanges, DSTs, and the Internal Revenue Code.

By Dan Wagner | Digital Exclusive - 2019

For the uninitiated, Section 1031 of the Internal Revenue Code provides an effective strategy for deferring tax on capital gains that arise from the sale of a business property or real estate investment. Simply put, by exchanging one property for “like-kind” real estate, property owners may defer taxes and use the proceeds to purchase replacement properties.

Any properties held for business use or investment—basically all the core commercial real estate property types—qualify as like-kind properties. For example, a duplex can be exchanged for vacant land, and an office building can be exchanged for a multifamily property. Virtually any type of real estate asset, other than a primary residence, may potentially qualify for tax-deferred exchange under Section 1031.

Now, pair the 1031 exchange strategy with a Delaware statutory trust (DST) and real estate owners can reap even greater financial benefits.

Dive Into DSTs

DSTs are governed by Internal Revenue Service Ruling 2004-86, which defines a DST as a “fixed investment trust” with a series of attributes that cannot be changed once the trust is established.

A DST is a passive investment vehicle that allows multiple investors to own fractional interests in a single property or portfolio of properties. The DST structure takes all the decision making out of the investors’ hands and places it into those of an experienced sponsor-affiliated trustee. And there are more DST benefits:

• No property management responsibilities: The property is professionally managed by a third party in the DST, therefore the DST acts as the single owner and agile decision maker on behalf of investors.

• Access to institutional-quality properties: Most real estate investors can’t afford to own multi-million-dollar properties. DSTs allow investors to acquire partial ownership in properties that otherwise would be out-of-reach.

•

Limited personal liability: Loans are non-recourse to the investors, and the DST is the sole borrower.

• Lower minimum investments: DSTs can accommodate much lower minimum investment amounts.

• Diversification: Investors can divide their investments among multiple DSTs, which may provide for a more diversified real estate portfolio across geography and property types.

• Estate planning: All 1031 exchange investments receive a step-up in cost basis so heirs will not inherit capital gain liabilities.

• Insurance: If for some reason the investor can’t acquire the original property they identified, a secondary DST option allows them to meet the exchange deadlines and defer the capital gains tax.

• Swap until you drop: The DST structure allows the investor to continue to exchange properties over and over again until the investor’s death.

Strategy in Practice

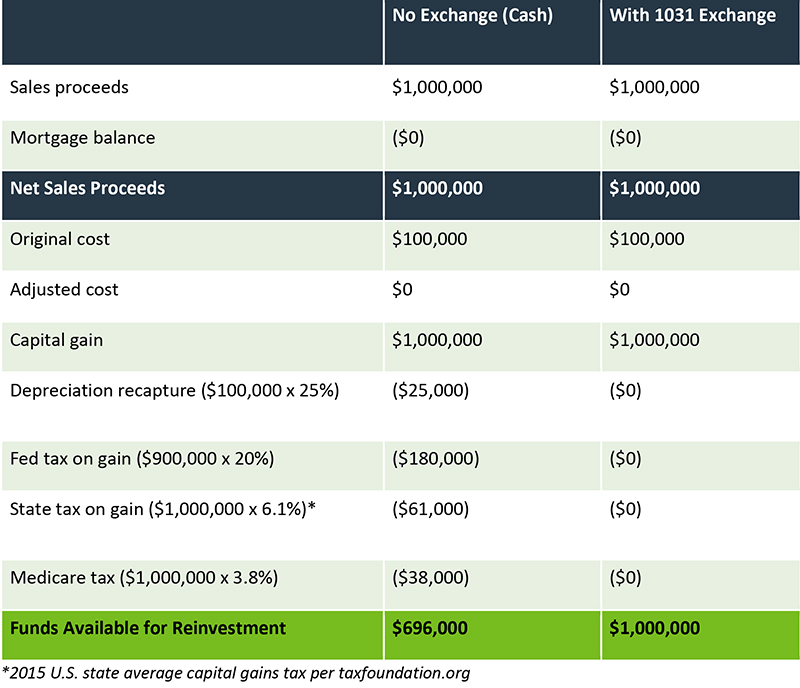

To illustrate why property owners and their advisors need to take this strategy seriously, here’s a look at a hypothetical property sale with and without using a 1031 exchange:

Through a 1031 exchange, property owners can change the form of their investment without cashing out or paying capital gains tax. There is also no limit on how many times an investor can exchange properties—they can roll over the gain from one investment to another. Leveraging a 1031 exchange could lead to hundreds of thousands of dollars more for reinvestment, and while property owners may make a profit on the exchange, their taxes will be deferred until they decide to sell out entirely to close their investments.

As you can see, the use of a well-thought 1031 strategy can yield a far greater ROI on real estate investments.

Daniel Wagner is the senior vice president of government relations for The Inland Real Estate Group of Companies Inc. He has been a licensed real estate broker since 2004 and holds FINRA Series 7 and 63 securities licenses. He is also the past president of the Chicago Association of Realtors.

This is neither an offer to sell nor a solicitation of an offer to buy any security, which can be made only by an offering memorandum or prospectus that has been filed or registered with appropriate state and federal regulatory agencies and sold only by broker dealers and registered investment advisors authorized to do so. An offering is made only by means of the offering memorandum or prospectus in order to understand fully all of the implications and risks of the offering of securities to which it relates. A copy of the applicable offering memorandum or prospectus must be made available to you in connection with any offering.

The views expressed herein may not be considered tax and/or legal advice. These views also should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.