The Evolution of Today’s CFO and Controller

The current COVID-19 crisis, the Great Recession, as well the rapid changes in technology and the business world in the last 10 years, have changed the role of the CFO and controller in middle market companies.

By Joe Lopykinski, CPA, and Mike Conti | Digital Exclusive - 2020

In today’s complex business environment, middle market company executives must better understand what is being asked of their financial leaders, how the demands of the finance function have changed over the last two decades, and which skills, personalities, and soft skills are prevalent in high performers.

Historically, companies have primarily valued the accuracy of financial data and the accounting department’s people and processes were purely seen as cost centers. As technology advanced, reducing costs through new systems created an ever-increasing pressure to lower accounting and finance costs while simultaneously increasing the value of the output from the department. Nowadays, an effective accounting and finance function is expected to not only keep track of past transactions but provide a vision for how to move forward. This evolution to forward-looking finance became apparent roughly 20 years ago but has greatly accelerated over the last decade.

Implementing automation and optimizing the efficiency of the accounting and finance function rests on the shoulders of the CFO and controller. When the department is running efficiently, the time gained needs to be spent on higher, value-added activities that directly impact both the top and bottom line of the business.

Demands of Today’s Accounting and Finance Function

What do businesses honestly want from their finance departments today, and are their finance departments delivering on those expectations? While companies demand better output from their finance function, they still pressure CFOs and controllers to keep their department costs down. Old-school executives may make the mistake of thinking that the way to lower costs is to pay talent less when the opposite is actually true. A

2017 study conducted by PwC surveyed more than 600 companies from around the world and showed that top-performing teams paid their professionals 25 percent more than average, but in those teams the entire finance function cost 36 percent less than the median. Companies that spend more for the best people are getting higher performance for a lower total price than their competitors.

Today, the CEO and shareholders want a CFO who is providing strategic guidance for the business. As a company becomes larger and more complex, there tends to be a greater emphasis on the CFO’s role as a strategic leader and less focus on a CFO’s tactical duties. But size is not the only factor in a push to a strategic role for the CFO: businesses of any size undertaking complex projects such as M&A, expanding product and service lines, or entering new domestic or international markets will want a CFO that can execute complex, big-picture, long-term strategies. Additionally, facing the current COVID-19 crisis, companies are forced to find ways to work differently, bringing strategic thinking to the forefront. Today’s finance leaders must be able to make tough, time-sensitive decisions to cope with immediate problems while still maintaining the company’s long-term strategy.

As the demand for increased financial value is put on the CFO, a significant portion of that burden is pushed down to the controller. Today’s controller often accomplishes this through automation. Rapid changes in enterprise resource planning, cloud technology, machine learning, and AI have made automation essential to staying competitive.

2018 analysis by McKinsey found that 77 percent of general accounting operations are now fully automatable, and almost all are somewhat automatable. Processes in cash disbursement, revenue management, and financial controls are also over 70 percent fully to somewhat automatable. Implementing the right systems is an undertaking for both the CFO and controller. It is also a significant reason to attract and retain the best talent throughout the finance function, so they can build and operate a system that provides more value and costs less over time.

Evolution of the CFO Function

The CFO’s role was traditionally very hands-on, managing tasks such as financial statement review and reporting, and managing the accounting and finance teams. The CFO was also the main point of contact for banks, building treasury relationships, and preparing and discussing corporate tax returns and tax strategy. The CFO was also responsible for disseminating financial results to owners and investors and preparing and presenting budgets and forecasts. Today, as the CFO role has become more strategic and is increasingly seen as the partner to the CEO or president, many of these traditional roles and duties are either shared with or handed down to the controller.

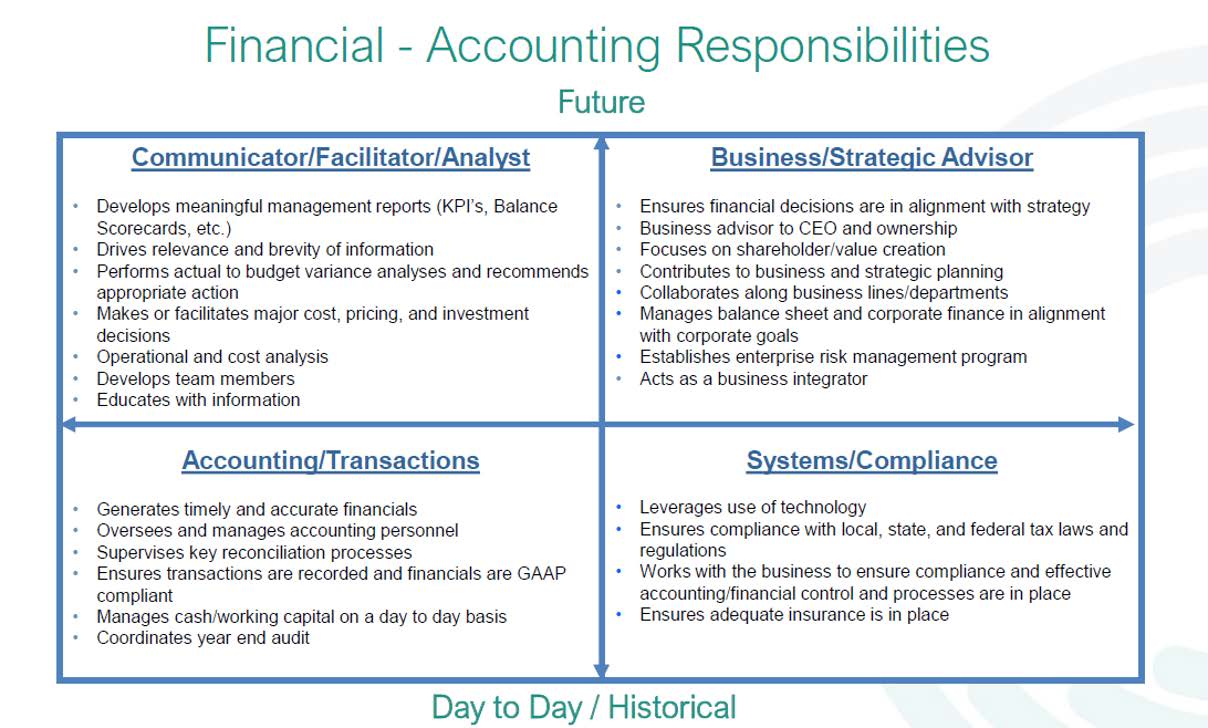

The chart below shows four distinct quadrants that categorize the primary types of responsibilities commonly found in today’s accounting and finance departments. The top two quadrants represent more strategic duties and the bottom two more tactical responsibilities.

A

2018 McKinsey study found that the CFO role has been broadening from traditional and even specialty finance roles, with increases in CFOs reporting they were responsible for board engagement, digital transformation, and investor relationships. Respondents also reported that while CFOs were delivering the greatest financial value for their companies in traditional finance roles, they were also contributing significant value to cost and productivity management, strategic leadership, and performance management.

With nontraditional finance roles like strategic leadership, organizational transformation, performance management, and data analytics consuming more of a CFO’s time than ever before, the CFO’s role will continue to adapt and change. CFOs who are not willing to spend significant time and energy in these areas run the risk of being left behind and allowing their companies to be left behind as well.

Changes in the Controller’s Role

The CFO’s role isn’t the only finance role that has changed over the years. Many of those changes have trickled down to the controller’s desk too. Traditionally, the controller role was seen as transaction-based. Responsibilities such as overseeing accounts payable and receivable duties, completing balance sheet reconciliations and month-end close tasks, assuming the main point of daily contact with external audit and tax teams, assisting in the annual budget, and completing variance analyses were often in the controller’s repertoire. Controllers also took on the role of staff development, often considered more of a tactical, hands-on responsibility.

While many of these tasks still fall to today’s controller, how these tasks are being completed is different, with an increased focus on process improvement for speed and accuracy. As finance departments are faced with the challenge of doing more with less, technology has played an increasingly critical role in these areas.

Today’s controller has more of a leadership role. In terms of staff development, the controller is seen as a coach, teacher, mentor, and recruiter. Controllers are also tasked with improving reporting through KPIs, balanced scorecards, and other measurement tools, while maintaining speed and accuracy.

In the future, the controller’s role will become even more strategic and process-focused, growing into a more visible business partner. With hiring and developing key talent becoming increasingly important, the controller will be tasked with empowering staff to grow with innovative methods of development. As COVID-19 brings new ways of thinking and operating, an even heavier emphasis on compliance and financial and operational controls will fall on the controller. The controller will also take on the tasks of assisting the CFO with pre-sale and acquisition work, integrating newly acquired companies, and finding opportunities to gain exposure in international markets. The future will be challenging—but fulfilling—for the controller!

Evolving Skills and Personality Traits of CFOs and Controllers

The skills and personality traits sought will vary based on the organization’s culture and strategic needs, but The Overture Group has found the following to be shared among many successful CFOs: adaptable, creative, engaging, motivational, a visionary leader, collaborator, and big-picture thinker. Successful controllers possess the following traits: multi-faceted, trustworthy, humbly confident, intellectually curious, team builder, and leader. Many characteristics and skills overlap both high-performing CFOs and controllers.

Here are three traits now required of both CFOs and controllers and how they are applied to each role:

Strategic Thinker

The CFO will be the key developer of the long-term strategy while the controller will need to understand the strategy to produce and report the respective meaningful metrics. The CFO will help define the metrics when he or she works with the other functional leaders to execute the strategy.

Collaborator

Both the CFO and the controller need to be collaborative as they are both key to disseminating data and management information throughout the organization. The controller works with other business managers to gather data and create a clear roadmap that highlights useful information among appropriate departments. The CFO uses that roadmap to make sure the department leaders are staying on course to reach the desired results.

Team Builder

Both the CFO and controller need to be collaborative as teamwork and talent development are essential. The CFO needs to play an active role in the talent strategy for the entire organization, and today’s controller needs to play a hands-on role in hiring and developing talent within the accounting and finance function.

The Current Market for CFOs and Controllers

The COVID-19 crisis has increased business owners’ and their management teams’ demands for more timely and relevant information. In addition, resources are scarcer, and the need to leverage technology is greater. Also, since the growth of private equity activity over the last 20 years has not slowed, there is still a high demand for talented finance leaders.

In other words, the future, while always difficult to predict, looks promising for CFOs and controllers. As businesses continue to demand more from their finance functions, top performers in these two roles will continue to be heavily recruited. Furthermore, the reality of a baby boomer generation continuing to face retirement means that the need for their replacements will be at a premium. Additionally, the COVID-19 crisis has tasked some companies with downsizing their accounting and finance teams, with some reductions coming at the expense of underperforming members, and some of these underperformers will be replaced by those with a higher degree of talent. Professionals who are strategic thinkers, collaborators, and team builders will have a leg up on their competition and be better positioned to face the challenges that lie ahead.

This article was written and provided by The Overture Group LLC, one of the Midwest’s premier search and compensation consulting firms.