The Real Risks of Retirement Investing

Assuming retirees will only need 70 percent of their working income is a dangerously misguided assumption.

By Ray LeVitre | Digital Exclusive - 2017

Anyone on the path to retirement can clearly see that today’s retirees are facing a completely different set of challenges than prior generations. This is the first generation in which retirees are carrying mortgages and other debt into retirement. Health care costs are expected to eat an ever increasing piece of the retirement budget. And an increasing number of people are entering retirement sandwiched between the needs of their financially-troubled adult children and their aging parents.

In view of the increasing costs of retirement, the traditional notion that retirees will only need 70 percent of their working income could very well be a dangerously misguided assumption.

Here’s why.

Longevity Risk

Compounding these challenges is longevity risk, which wasn’t much of a concern for prior generations. While most people may understand they can expect to live longer, few realize that life expectancy is constantly expanding, meaning that the older you get, the greater you can expect to live. Today, there is a 25 percent chance that one of the spouses of a 65-year-old couple will celebrate their 95th birthday, and it’s more than likely to be the wife. The greater risk is that few 65-year-olds fully grasp the enormity of this risk.

The risk of longevity is further compounded by the risk of inflation. Even at an average inflation rate of three percent, the cost of living will double in 20 years, putting many retirees’ lifestyles in jeopardy. Any resurgence of inflation to the levels seen in past decades could have a devastating impact on the lifetime income value of your assets.

Conservative Risk

For many people, the further they move down the retirement path, the greater the temptation to invest more conservatively. This is understandable; however, tilting your allocation towards conservative investments too quickly can expose your financial security to a much larger risk, which is the loss of your purchasing power at the time you really need it.

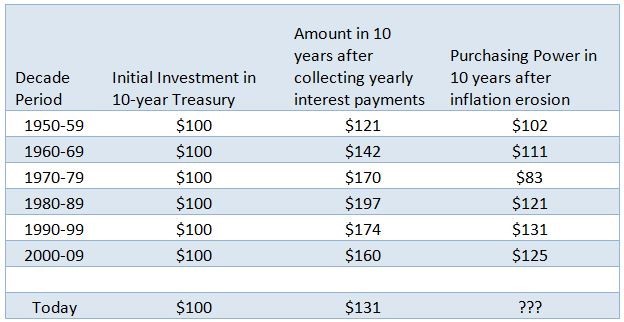

The chart below illustrates the erosion of purchasing power on earnings generated from an investment in 10-year Treasury Bonds. The decade of 2000–2009 had one of the lowest rates of inflation in the last 30 years, as measured by the Consumer Price Index (CPI), yet purchasing power on the earned income declined by 25 percent. It’s important to note that the CPI, which is the official government measure of inflation, doesn’t include food and gas prices which have increased at rate three times the CPI over the last couple of years. If food and gas prices were included in the CPI, the rate of inflation would be closer to 10 percent, and, at that rate, the net purchasing power of earnings in ten years would be less than the initial investment, meaning you would have lost money.

Investing in safe or guaranteed instruments may provide peace-of-mind that you won’t “lose” any money due to market fluctuations; however, each day that your returns fail to exceed the real rate of inflation, you are, in effect, losing money, and that loss becomes more pronounced over time.

Managing Risks

There are ways to invest conservatively that can reduce portfolio volatility while addressing the risk of inflation. The key is in knowing what your financial objective is in real terms by factoring in the true cost-of-living and taxation. Once you know the real rate of return that must be achieved to provide sufficient lifetime income, a diversified portfolio of equities and fixed-income securities can be constructed to match your particular risk profile.

With an investment strategy tailored to your specific needs and objectives, you need not take any more risk than is absolutely necessary. A well-conceived investment strategy focuses on managing the risk and volatility of your portfolio; your job is to stay focused on your objective.

Ray LeVitre is the author of “20 Retirement Decisions You Need to Make Right Now” and the founder and managing partner of Net Worth Advisory Group. His unique perspective of the financial industry comes from 19+ years of experience in investments at Fidelity, Citicorp, and Merrill Lynch and as an insurance agent at Mutual of New York-MONY. He can be reached through his website.