Breaking the Chain

How blockchain, the very legitimate technology behind cryptocurrencies, might change accounting and finance forever—in a good way.

By Lisa Wilder | Fall 2017

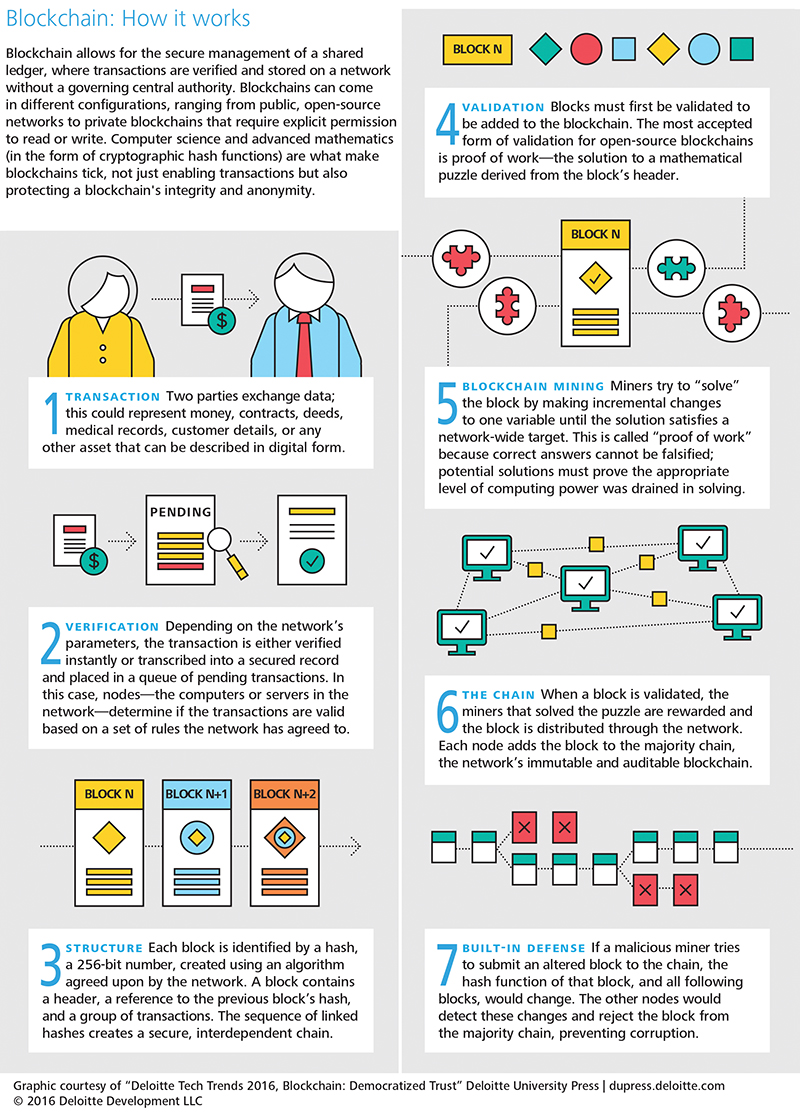

Consider a technology that could make traditional reconciliation

obsolete—a cloud-based, crowdsourced digital ledger

where every transaction is recorded and verified by users in

real time based on an honor system between all participants.

Now, consider this technology is rooted in the alternate currency

movement—aka cryptocurrency—with all the requisite

concerns about security, access, and trust that go with it.

Could the accounting and finance industry possibly adopt

such a technology?

Welcome to the blockchain discussion.

Blockchain or Bust

In case you haven’t heard, and you wouldn’t be the only

one—a recent Deloitte survey indicated that about 40

percent of senior U.S. executives haven’t—blockchain

technology is sparking an operations revolution in practically

every industry on the planet. The race is on to adapt

the open-source, live entry-and-verification technology behind

the soaring cryptocurrencies Bitcoin and Ether to

streamline recordkeeping and business transactions in disciplines

spanning from cross-border financial transactions

to supply chain management.

But what is blockchain?

In the simplest terms, a blockchain is a distributed digital

ledger that records and executes transactions without the

need of a middleman. And it’s all based in what many in the

accounting and finance profession still consider the ultimate

cultural and operational challenge—“accounting in the

cloud,” explains Lamont Black, assistant professor of finance

at DePaul University - Chicago. “Blockchain is really good

at recording a value and putting a timestamp on it. Instead

of everyone having their own files, they can go to one location

where everyone can agree on that shared information,

allowing it to be used centrally.”

Deloitte’s definition goes deeper: “[Blockchain] is a

distributed ledger that provides a way for information to be

recorded and shared by a community.” Every member of

this community maintains their own records, but “all

members must validate any updates collectively.” And we’re

not just talking about numbers. “The information could

represent transactions, contracts, assets, identities, or

practically anything else that can be described in digital

form. Entries are permanent, transparent, and searchable,

which makes it possible for community members to view

transaction histories in their entirety,” the firm explains.

And here’s where the name comes in. According to

Deloitte’s explanation, each update is a new “block” added

to the end of the “chain.” A central protocol is established

to determine how “new edits or entries are initiated,

validated, recorded, and distributed. With blockchain,

cryptology replaces third-party intermediaries as the keeper

of trust, with all blockchain participants running complex

algorithms to certify the integrity of the whole.”

Who knows what the future holds for this technology, but

today, a blockchain looks like a conventional database—just

one that moves and changes in real time. “It records all

processes, tasks, and payments and digitally stamps them.

It basically does what human intermediaries do now, but

without the potential for human error or tampering,”

explains W. Brooke Elliott, professor of accountancy

and department head at the University of Illinois at

Urbana-Champaign. “It’s protected from any type of

tampering or revision.”

Building a Chain

Deloitte is just one of many organizations exploring and

developing new ways to implement blockchain technology.

Another Big Four member, PwC, is investing heavily in

resources to develop blockchain applications and services.

Powerhouse names like Goldman Sachs, IBM, Intel, J.P.

Morgan Chase, Morgan Stanley, and Wal-Mart are just a few

others forming their own blockchain R&D collaborations.

Deloitte recently opened a global blockchain lab to develop

applications for the technology. According to Deloitte’s New

Jersey-based audit partner Will Bible, the development of

blockchain technology benefits from a vibrant global, opensource

community. “We’re seeing small groups of

entrepreneurs building their own solutions, with software

communities putting out their own platforms,” Bible explains. This open-source collaboration means

blockchain’s development won’t necessarily be led

by the computer and software industry—though

how it’s commercialized remains to be seen.

The decentralized computing network Ethereum, for

instance, has emerged as the latest platform of

choice for commercial blockchain development,

with some calling it “a more flexible and developer-friendly

alternative to Bitcoin with its native

cryptocurrency, Ether.”

Regardless of the platform, “blockchain is the real

innovation of Bitcoin,” Black says. “This technology

can be applied.”

The CPA Chain

There’s no clear answer as to how widely blockchain

technology will be applied, or how it will impact

accounting, finance, and tax professionals—yet. For

now, blockchain awareness is simply “important for

CPAs at all levels,” says Len Steinmetz, director,

Financial Services Advisory at Grant Thornton.

“It’s not generally expected that blockchain will

become the de-facto transactional standard at all

levels of the economy,” Steinmetz says, pointing to

current predictions that the early adopters will be

“top-tier financial corporations, asset managers, and

other large economic enterprises,” including “retail

banking transactors, payment system processors

(SWIFT already has a blockchain product in beta),

swap and other trading platforms.”

He adds, “For mid-tier firms, we’re probably looking

at a three-to-five-year horizon where small

businesses will likely be the last to adopt or may not

adopt outright, instead using platforms that use

blockchain technology ‘under the covers.’”

This means CPAs and other finance professionals

have some time to immerse themselves in

the technology and learn about its best implementations—

especially if they want to stay relevant to

their organizations and clients.

In other words, accountants and auditors won’t

be tossed out on the street, but now is a good time

to educate. Deloitte’s Bible says traditional

accounting support roles are likely to switch from

reconciliation to analysis. This technology will

automate many job functions, but also “create

opportunities for analytics,” Bible notes, and firms

will obviously be looking for job candidates with

the latest technical skills.

Take traditional double-entry bookkeeping, for

instance. According to Steinmetz, accounting

reconciliation typically depends on independent

auditors to verify entries and validate financial

information. Depending on the design of the

blockchain system, once data is entered, it’s subject

to an immediate verification process that refines or

completely eliminates this manual job function.

“Blockchain addresses these concerns by, first,

distributing identical copies of the ledger to each

member in the network (so everyone has the same

view into the transaction at the same time); second,

identifying ownership and transfer of ownership;

and third, cryptographically securing the ledger and

each transaction in a managed and immutable

way,” Steinmetz explains.

Then consider triple-entry bookkeeping and

momentum accounting. Blockchain is seen as a

potential modern driver of these proposed

alternative accountancy systems, which not only

focus on the traditional process of recording debits

and credits, but also monitor and note real-time

changes in balances.

The blockchain future means “the accountant and

auditor function would deal less with the mundane

and more with truly complex transactions. [It’s a

future] where today’s CPAs will make significant

value-add contributions,” Steinmetz adds.

The blockchain future can also potentially change

accounting coursework worldwide. Steinmetz

thinks training will have to change in two key ways:

Accounting majors will need a “firm grounding” in

“distributed ledger technology, cryptography,

security, and operation of trusted and trustless

networks.” Plus, they’ll need to build “a good

understanding of the coming world of blockchain

or ‘triple-entry’ accounting.”

DePaul University and the University of Illinois are

among many institutions responding to these

developing technologies with increasing levels of

computer science coursework.

“When I moved to Chicago in 2013, I was teaching

money and banking—I was talking about how

technology is changing the [finance] space. Even

then, my students wanted to know about Bitcoin

and the technology behind it,” Black says. “Today,

the school is developing a blockchain curriculum

that involves more conversation with faculty in

computer science.”

At the University of Illinois, Elliott just led a major

undergraduate curriculum revision in the College of

Business to build analytics and other technology-related

courses into its core. “We’ve always

produced accounting professionals with a solid

understanding of accounting fundamentals and

an ability to communicate well with colleagues

and clients, but now we’re investing to produce

accounting professionals who also have a

competency in data analytics and emerging

technologies,” she says. “In our masters programs

in accountancy, we’re launching a data analytics

concentration where students will have the ability

to build a core competency in analytics and apply

these skills to develop solutions to problems

identified in the accounting discipline.”

As for what the future holds for these students

and the profession, Elliott says don’t believe

everything you read.

“I don’t believe it’s the end of the audit industry by

any means, as has been referenced in several

popular press articles,” she says. “As long as there’s

estimation in financial reports, and there always will

be, then technology alone cannot substitute the

value [we] provide.”