Ethics Engaged | Fall 2021

The Ethics of ESG Investing

As ESG investing grows in popularity, those looking to invest in purpose-driven organizations should think through the ethical considerations.

Elizabeth Pittelkow Kittner

CFO and Managing Director, Leelyn Smith LLC

Exploring Ethics in Business & Finance Today

Interestingly, one of the most popular trends in investing is being driven less by financial

factors and more by behavioral factors. The rising appeal of organizations who prioritize

their environmental, social, and governance (ESG) behaviors—and the anticipated positive

impacts of these behaviors on these companies’ market values—is driving more investors

to consider how ESG investing fits in with both their ethics and their financial plans.

A company’s ESG disclosures offer more insight into its culture and mission than what an

investor might gather from simply reviewing the company’s technical valuations and financial

metrics. In essence, ESG disclosures empower investors to invest in organizations that respect

or support the issues they care about themselves. For example, Investopedia notes the

environmental considerations may address issues like energy consumption, pollution, climate

change, waste production, natural resource preservation, and animal welfare; social

considerations could include human rights, child and forced labor, community engagement,

health and safety, stakeholder relations, and employee relations; and governance

considerations might include quality of management, board independence, conflicts of

interest, executive compensation, transparency and disclosure, and shareholder rights.

One of the first ethical considerations surrounding ESG investing is the difficulty both

companies and investors face in applying common reporting standards. Various ESG

reporting standards and frameworks have been developed by the Sustainability Accounting

Standards Board, the Task Force on Climate-Related Financial Disclosures, the Global

Reporting Initiative, the Global Real Estate Sustainability Benchmark, United Nations’

Principles for Responsible Investment, and the Dow Jones Sustainability Indices, just to

name a few. Additionally, the International Financial Reporting Standards Foundation has

declared its intent to create its own standards. ESG investments may be difficult to compare

if the companies being analyzed are reporting ESG components under different

frameworks. Similarly, the ESG ratings assigned to stocks from organizations like

Bloomberg, the Carbon Disclosure Project, Institutional Shareholder Services, MSCI,

Sustainalytics, Thomson Reuters, and Trucost may vary widely across vendors for the same

stocks because their rating systems use different sets of criteria to judge the stocks.

A second ethical consideration when considering ESG-driven investments is the threat of

greenwashing, meaning that investment managers may be marketing investments toward

ESG-conscious investors without substantive ESG initiatives associated with the

investments. The former chief investment officer of BlackRock, the largest asset manager in the world, has been outspoken about how ESG is being used largely for marketing hype. Fortunately, investors can fight against greenwashing by reading the investment prospectuses and talking to the fund managers about how the management fees are being used. Fees for ESG-focused funds tend to be higher than those that track the broader stock market. Additionally, ESG-related funds tend to have varied success in outperforming funds that track indices like the S&P 500. Still, investors are increasingly shifting money toward ESG-focused funds because they believe in the long-term sustainability of them. According to Morningstar Inc., cash flows into sustainable investment funds in the United States reached $51.1 billion in 2020—more than double 2019 levels and a nearly 10-fold increase from 2018.

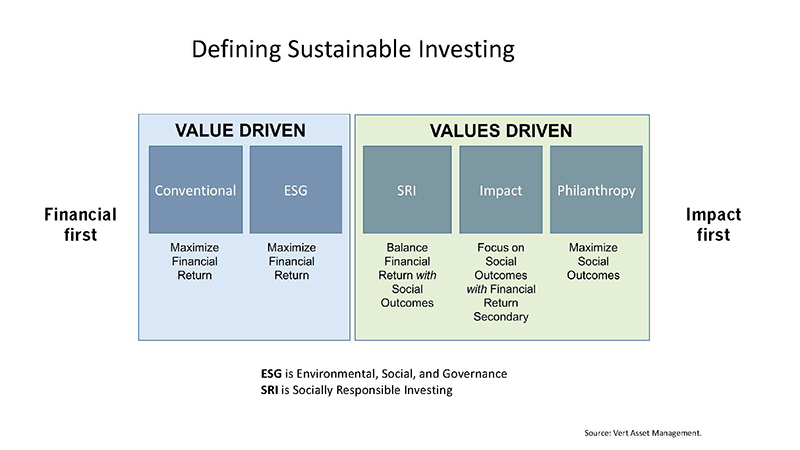

A third ethical consideration is determining your own individual ethics for investments. On one end of the spectrum, investors prioritize maximizing financial returns, and on the opposite end of the spectrum, investors prioritize maximizing social outcomes. The chart below from Vert Asset Management illustrates this spectrum. In their interpretation, ESG falls into the financial-first side of the spectrum. In other words, ESG initiatives focus on how the organization’s behaviors impact its financial performance. Since an ESG focus prioritizes the organization’s values to promote financial returns, investors may prefer to invest in organizations that emphasize social outcomes.

SRI (socially responsible investing) is the strategy of investing in organizations that support the investor’s individual values. For example, some investors intentionally avoid sin/vice stocks, such as organizations involved in alcohol, gambling, or tobacco. Realistically, these organizations could still score high on ESG frameworks based on lower energy consumption, higher community engagement, strong quality of management, or other factors. Since a socially responsible investor may make different investment decisions than an ESG-focused investor, it is important to know your preference and discuss it with your investment manager.

Impact investing goes further than SRI, prioritizing social outcomes over financial outcomes. Vert Asset Management CEO Samuel Adams says to think about this category as a “for-profit version of philanthropy. It’s realizing that some social problems are only alleviated, but not solved by continually donating money, medicine, and food to these problem areas. Sometimes it’s better to invest in a business that will provide those services on an ongoing basis.” Impact investing usually involves private funds versus the publicly traded funds available for ESG and SRI.

The Forum for Sustainable and Responsible Investment reported that ESG, Impact, and SRI investing grew from $3 trillion in 2010 to $12 trillion in 2018. While all three categories offer investors unique opportunities, ESG has grown the most, partly because ESG factors supplement existing measurements of organizational performance.

While focusing on ESG is bringing more purpose to investors, it also has been improving the way business is conducted. High ESG ratings create positive effects for an organization, such as bringing more purpose to the organization, improving employee morale, facilitating conversations about values between the organization and its investors, raising cash flow for the organization, and lowering the cost of capital. Also, organizations who have sustainable business models and ongoing ESG initiatives are expected to outperform competitors. CPAs can think about their own sustainability strategies internally and consider offering ESG services to clients to help them identify their sustainability strategies.

As investment options grow to meet investor preferences, we will continue to see more organizations looking to implement sustainability initiatives. If you are looking for purpose-driven investments, focusing on ESG may be a good place to start your due diligence.