Becoming a Corporate Finance Futurist

Companies demanding deeper insights and better business strategies are focusing

their finance teams on the future.

By KRISTINE BLENKHORN RODRIGUEZ | Summer 2019

“No amount of sophistication is going to allay the fact

that all of your knowledge is about the past and all your

decisions are about the future.” The words of GE’s

former strategic planner and founder of its “future

studies” group, Ian Wilson, still hold true. But finance

professionals today have more tools at their disposal

than ever to help them think like futurists and plot their

companies’ futures as well as their own.

The question remains, are artificial intelligence (AI),

robotic process automation (RPA), machine learning,

predictive analytics, and other digital technologies the

crystal balls and magic bullets so many have wished for?

Bots & Bytes

Finance roles and responsibilities are expected to be among the

most impacted by digital technologies like AI and RPA. For now,

though, many finance departments are planning for the 21st century

while working with methods still belonging to the prior.

The average corporate finance team spends roughly 80 percent

of its time on non-value-added manual processes like gathering,

verifying, consolidating, and formatting data, leaving just 20 percent

of their time for higher-level financial planning and analysis,

according to findings in Adaptive Insights’ CFO Indicator Report. So

much for being futurists.

The risk is that many of today’s finance professionals are focusing

most of their time on tasks that could soon be automated, leaving

them vulnerable as more sophisticated forms of AI and RPA creep

into daily finance functions and organizations increasingly ask for

deeper business insight and strategy from the finance team. “Very

quickly we’re going to be in a world where, if you don’t have skills

in robotics and the related technologies, you will be obsolete as a

finance person,” KPMG CFO David Turner recently told CFO.com.

At the beginning of 2019, Turner, an RPA bull, said the firm was

about 55 percent of the way toward achieving an initial goal of

creating 200,000 hours of workforce capacity savings.

Bots can process transactions, monitor compliance, and audit

processes automatically. And many of the bots being developed

today learn as they go. Through machine learning, bots improve all

on their own, based on new data and new experiences, which cuts

down on the manual work finance professionals have previously

done and, arguably, has held them back from largely becoming

more strategic business advisors.

Accenture’s David Axson, global lead of CFO strategies, says some

executives are surprised when they see just how much of corporate

finance’s day-to-day can be done by technology: “Many are

dismayed because they’ve traditionally seen their job as the preparer

of financial reports and now technology is usurping that role. What

they don’t realize is that in today’s digital era, finance’s job begins

when they deliver the report or analysis. Their role is now primarily

an advisor on major business decisions, not a report compiler.”

The scenario is increasingly playing out. In “Bots, Algorithms, and

the Future of the Finance Function,” McKinsey & Company

highlights how AI can outdo veteran talent: “At a heavy-equipment

producer, managers had long used spreadsheets to forecast

monthly sales and production. Frustrated with the time consumed

and the imprecision of manual forecasts, they tasked a team of four

data scientists with developing an algorithm that would automate

the entire process. Their initial algorithm used all the original sales

and operations data, as well as additional external information

(about weather and commodities, for example). In this case, within

six months the company eliminated most of the manual work

required for planning and forecasting — with the added benefit that

the algorithm was better at predicting market changes and

business-cycle shifts.”

Another case in point: Willis Towers Watson’s use of RPA. “Intelligent

automation boosts both day-to-day finance functions and the

quality of finance’s strategic insight,” says Willis Towers Watson CFO

Michael Burwell in an interview with CFO.com. “We use robotics to

retrieve invoices in response to various queries by state and local

tax authorities. It’s an important step, because both the number of

reviews per day and the amount of data requested is growing

exponentially. My tax team can assign the robot a task and time to

retrieve invoices in advance of a tax examination. A key advantage

of using robots is their ability to work off-peak hours when staffers

are home. When they arrive in the morning, they have invoices and

a status report to review.”

More CFOs seem to be catching on to what the future can hold for

their finance teams. According to Grant Thornton LLP’s 2019 CFO

Survey, 38 percent of senior financial executives currently

implement advanced analytics, while 30 percent have adopted

machine learning. And over the next two years, an increasing

number of CFOs will invest in AI (41 percent), RPA (41 percent),

blockchain (40 percent), and drones and robots (30 percent).

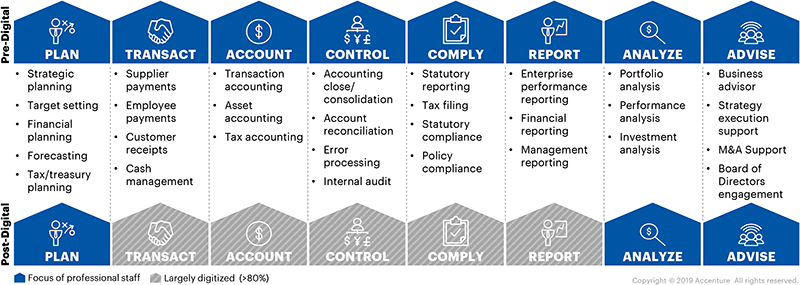

When Axson maps out the task list for corporate finance teams in the

pre-digital and post-digital worlds, it becomes clear that the traditional

role of finance must change. “Intelligent machines can sift and sort

through vast data sets — sets far too large for humans to accomplish.

And those same machines can identify patterns we humans simply

can’t because of the volume of data. Machines also do things like

this with far less error than humans do. If you want to know the impact

of changing pricing or building a new factory, AI can help faster and

in ways humans can’t,” Axson explains.

That said, Axson makes it a point to note that humans empathize,

ideate, create, and converse with each other for better solutions

far more effectively than any bot. “AI is not a cure-all. For example,

AI is not great at predicting black swan events,” he explains.

Ultimately, “CPAs need to think of themselves as more than

accountants,” Axson says. “They are moving up the value chain to

become more of a business partner and a strategic enabler —

providing solutions versus simply transactions. To do that well, it helps

if they have a strong grasp on what lies ahead for their companies.”

Becoming a Finance Futurist

Futurist, economist, and self-proclaimed human spark plug and

brain shaker, Rebecca Ryan, smiles to herself when executives think

what she does is shrouded in mystery. “’Futurist’ is a wonky term, I

know, but we’re all futurists of a sort. If you’re trying to figure out

retirement savings or the weather for your vacation, you’re doing

what I do. I just do it with a lot more training and tools,” she says.

When it comes to corporate futures, Ryan says a surprising number

of the business leaders she works with hesitate to shine a light on it.

“Most of us tend to think the future is a dark room. And we don’t want

to go in there because we don’t know what awaits us. We’re afraid

of the bogeyman.” Her job is to prove the bogeyman is a myth and

that what leaders plan for has more power to help than to hurt.

In practice, Ryan uses “The Foresight Wheel” to walk business

leaders through a futurist’s thought process, a multi-step method

of developing strategic foresight by asking “Where is the world

likely to be?” and then working backward from there.

Step 1: Frame the domain. Here, specificity is required. What do

you want to explore or accomplish and by when? Think of the future

of your company by 2025 or 2030.

Step 2: Scan for forces and trends. This is where a good futurist

helps. Ryan says she looks for forces and trends that move leaders

beyond their own biases, like the common availability bias, where

we over-rely on sources we remember instead of what’s true. In

this step, Ryan takes executives through what she calls the STEEP

areas: society, technology, economics, environment, and politics.

First, look at society. Are your customers changing? Are their

attitudes different as a new generation comes to the fore? Second,

technology. What’s on the horizon — AI? Robotics? Third, economics.

How is the gig economy or unemployment impacting your

workforce? Are your customers or clients being hit by tax regulation

or trade conflicts? Fourth, environment. With climate change, are

carbon taxes and environmental credits going to become a business

concern? Fifth and finally, politics. How will changing leadership

impact your regulatory and business environment?

Step 3a: Forecast scenarios. Many businesses plan on their best-case

scenario or what Ryan calls “rainbows and fairy dust.” It’s

aspirational, but no professional futurist will let you get away with

that scenario alone. She usually walks people through a “watch-and-wait”

future. What happens if we don’t do anything differently? Then,

an aspirational, best-case-scenario future. What happens if we have

all the right people doing the right things with the right resources?

For the third future she asks business leaders to imagine a negative

disruption. This future is filled with black-swan events. What if a client

that accounts for 20 or 30 percent of your revenue makes a sudden

change in leadership and your firm is no longer working for them?

And the fourth future envisions a positive disruption. What if two of

your biggest clients double in size?

Imagining all these futures gets people out of their boxes — optimist,

pessimist, etc. — and considering a wide range of possibilities.

Step 3b: Identify crossover issues. This is where you look at the

four scenarios you’ve just laid out and say, “What are the things we

can control that would help us regardless of which scenario plays

out?” You can’t control the economy or who comprises a major

client’s C-suite, but you can control other things like your hiring

practices, R&D, or investigating new areas of business.

Step 4: Envision the future. What is our highest vision of the future,

and what will success look like in that future?

Step 5: Backcasting. Starting from your end domain (whether that’s

2030 or just three years out), work backward to fill in your strategic

plan. What actions and outcomes need to take place to achieve

your business’s goals?

Step 6: Implement. What are the steps to take now to set your

strategic plan in motion and get you headed toward your future state?

Sparking the Conversation

Don’t mistake strategic foresight as being reserved for the C-suite.

It’s not just about how executive groups think.

“Bring some weirdos into your planning sessions,” Ryan encourages.

“And I say ‘weirdos’ in the most positive way. You should have a

stable or ecosystem of talent to choose from.” Ryan says she has

seen chief innovation officers, entrepreneurs, and young college

teaching assistants and professors fill this role, but the options are

endless — even interns could contribute.

“Have them sign an NDA and then bring their creativity and

ingenuity to your table. They will take you out of groupthink, out of

the mode in which your ‘new’ plan is just last year’s plan with slight

updates,” Ryan stresses.

She recalls one organization she worked with that had turned to its

next-generation employees to help identify ways to better attract and

retain employees. This young talent set brought six projects to the

company’s leadership team. Leaders had to green-light, yellow-light,

or red-light the ideas, but they had to give clear reasons as to why.

“I was in the restroom during a lunch break when I heard one of the

female partners at this firm exclaim that she had no idea the firm had

such talented young employees with such innovative ideas.

Sometimes, your brilliant nonconformists are right under your nose.”

While strategic foresight is still a little “out there” for many

organizations, Ryan says it can’t stay like this much longer. In a

world that is constantly changing, strategic planning will only take

you so far. Instead, be the “human spark plug” that ignites the

impetus for overcoming organizational inertia. It certainly beats the

crystal ball approach.