Firm Journey | Winter 2019

When Worlds Collide: The CPA’s Future Is Now

Non-CPAs are increasingly influencing the accounting industry. So, what can CPAs do about it?

Tim Jipping, CPA, CGMA

Owner, Journey Advisors & CPAs

Navigating the Accounting and Consulting Landscape

How often do we talk about the firm of the future—the one that is three, five, and even 10

years out? What if I challenged that the firm of the future exists today? In fact, your firm is

one of them. Call me arrogant or call me naïve—you can even call me both. But I’d like to

argue that the game-changing differentiator between the firm of today and the firm of the

future is as simple as this: Discomfort.

You’ve read a paragraph and are probably convinced that I’ve lost it. Hear me out, and

consider a few things:

• Intuit now directly offers to consumers (our clients) software and cloud applications in

three core business areas of many CPA firms (bookkeeping, payroll, and tax).

• There are major software companies improving payroll administration to such a degree

that CPA firms could be pushed out of performing payroll services for good.

• The increasingly easy access to outsourced and even offshore bookkeeping outfits,

combined with advances in automation, are already resulting in fewer opportunities

for CPAs.

If you’re a CPA, these developments should make you uncomfortable. If you run a small or

midsize CPA firm, you should be concerned about what your future holds. And if you

happen to be in a large firm, don’t think you’re in the clear. The non-CPAs, and even non-accountants,

that are impacting our industry are making it easier for smaller firms to

compete with you as the attention of all CPAs must turn to providing more than just

traditional accounting, audit, and tax services. I predict that the more service displacement

we see in the near-term, the fiercer the competition between all firms will get.

THRIVING IN DISCOMFORT

The firm of the future is the uncomfortable firm. Adapters will win. The exponentially

increasing rate of disruption in our industry magnifies the importance of adaptability.

Adaptability, however, is not a one-time thing—it’s a continuous process, a consistent state

of being. Discomfort is a sign that a firm is aware of the challenges and disruptions around

it and that it is seeking to adapt in order to thrive.

In the martial art of Judo, the technique of Kuzushi is employed to deflect an attack and

use an opponent’s momentum against them in order to gain control over them. Rather than

putting energy toward resisting the changes in our profession, leaders in the firms of the

future embrace change as an opportunity and seek ways to exploit the competition of both

the non-CPAs and non-accountants entering our space.

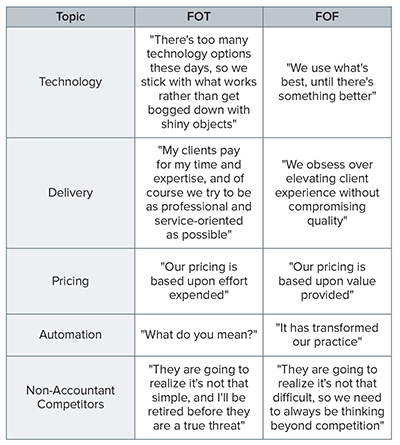

How do you know if you’re a firm of the future or a firm of today? Here are a few examples

of how each firm might respond to a few relevant professional topics:

POSITIONING FOR SUCCESS

Not all the firms of today are going to die off—but I’m willing to bet

they’re not experiencing meaningful growth or crazy success. In

order to ensure you’re positioned for success as a firm of the future,

you’ll need to carefully examine your processes, services, and

business model.

Start by mapping out your processes, from onboarding clients to

service delivery. Don’t document what SHOULD be happening;

document what IS happening. Think of the following: How do you

onboard new clients and load them into your platform? How do you

define and communicate expectations? Are your clients clear on

what will be required of them? How do you obtain the necessary

information from clients, and how is it distributed to your team?

Have priorities and timelines been properly established and

communicated? Do you know if you’re on schedule? Do you have

defined deliverables? How do you collect payment? What are the

routine bottlenecks and obstacles in your processes? Can

automation, increased training, improved communication, fewer

touch points, or additional people be solutions?

Next, examine your services. How much of what you do falls into

the compliance category? Realize today that compliance work will

only continue to become more automated, offering less work (and

declining revenue) for CPAs in the future. You must begin to

determine how you can spice up your services to be value-focused

versus compliance-focused. Consider a few of these examples:

• Shift your focus to tax planning versus tax preparation (and

charge a premium for it!).

• Provide a few observations and insights with clients’ monthly

financials.

• Leverage reporting software to elevate your deliverables and

provide more insight.

• Begin communicating to clients how they compare to industry

peers and benchmarks.

• Proactively introduce clients to new tools or approaches that

could help them achieve their goals (ahem, you’d first have to

understand what their goals are to do this, by the way, which is

another client engagement opportunity).

Finally, examine your business model. Your firm’s structure could

be in direct opposition to its goals. For example, while your

expertise may be in business tax planning and compliance, over

the years you may have taken on a substantial amount of payroll

administration for your business clients. But payroll administration

is never ceasing, and the revenue-per-hour ratio is not all that high,

which could make it difficult to grow your practice in other areas

without making some structural changes.

It’s not at all uncommon for client relationships to be in the hands

of one individual or a small handful of staff, thereby consuming

significant chunks of their time and creating bottlenecks.

Intentionally shifting points of contact early on in a client relationship

could improve service delivery and client experience, while also

elevating your team’s ability to serve and communicate with clients.

This may require more structured training for your team, or even

enhanced titles for your team members to improve the client’s

perception of their point of contact.

Also consider creative measures to incentivize your team’s

performance. And when I say creative, I don’t mean off-the-shelf

bonus plans—think profit sharing based on performance metrics or

establishing an employee-owned entity designed to attract and

grow a certain niche. Remember, you didn’t get to where you are

alone, and you certainly won’t emerge as a successful firm of the

future alone.

I contend that adaptability, flexibility, and creativity will be the keys to

success for firms of the future. With firm size and structure having a

lot to do with how adaptable, flexible, and creative you can be, I think

small and midsize firms can realize the greatest opportunities for

success as non-CPAs and non-accountants disrupt our industry. If

you can get comfortable being uncomfortable, then becoming a firm

of the future is about continually reimagining your firm of today.