Evolving Accountant | Winter 2021

SAS 134-140: A Review of Upcoming Audit Changes

As the effective date of SAS 134-140 arrives, auditors should prepare for the biggest changes to the audit process and auditor’s report.

Andrea Wright, CPA

Partner, Johnson Lambert LLP

Trends in Accounting, Auditing, and Consulting

In light of challenges arising from the coronavirus pandemic, the implementation of SAS

134-140 was effectively delayed by one year. According to SAS 141, “Amendments to the

Effective Dates of SAS Nos. 134-140,” SAS 134-140 are effective for audits of financial

statements for periods ending on or after Dec. 15, 2021. As auditors prepare to implement

SAS 134-140, here is a summary of the most significant changes to the auditor’s report and

the audit process.

SAS 134: Auditor Reporting and Amendments, Including Amendments Addressing Disclosures in the Audited Financial Statements

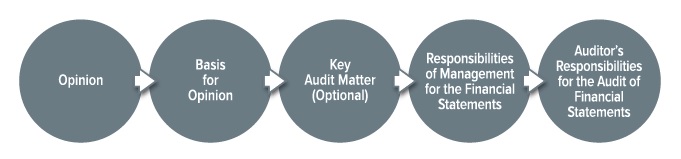

SAS 134 changes the layout and the content of the auditor’s report to align more closely

with the standards of the Public Company Accounting Oversight Board and the International

Auditing and Assurance Accounting Standards Board. The new standard suggests reporting

the content in the following sequence:

The auditor’s report suite supersedes several AU-C sections in their entirety and introduces

AU-C Section 701, “Communicating Key Audit Matters in Independent Auditors Report.” The

communication of key audit matters (KAMs) is optional and included in the auditor’s report

following the “Basis for Opinion” paragraph only when those charged with governance

have engaged the auditor to report on KAMs.

The determination of KAMs is a matter of professional judgment, and therefore the reporting

of KAMs will vary between entities even within the same industry, as well as from period to

period for the same entity. In determining which matters to report when engaged to report

on KAMs, the auditor should evaluate matters that required significant attention during the

audit, such as areas of high assessed risk of material misstatement, significant risks, areas

requiring significant auditor judgment, and the impact of significant transactions and events.

Auditors should note that an item reported as a KAM should not also be included in an

emphasis-of-matter or other-matter paragraph in the auditor’s report.

There is a new statement under the “Responsibilities of Management for the Financial

Statements” section of the auditor’s report, making it clear that management has the

responsibility for evaluating going concern.

The “Auditor’s Responsibilities for the Audit of Financial Statements” section has been

expanded to include descriptions of the following:

- Reasonable assurance.

- Circumstances that may prevent material misstatements from being detected.

- Materiality.

- Requirement to conclude on the entity’s ability to continue as a going concern.

- Exercising professional judgment and maintaining professional skepticism.

- Required communications with those charged with governance.

SAS 136: Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA

SAS 136 applies to audits of employee benefit plans that are subject to the Employee Retirement Income Security Act of 1974 (ERISA) and will impact both auditors and administrators of ERISA plans, and addresses the following:

- Changes to the form and content of the auditor’s report, including when management elects to have an audit performed pursuant to ERISA Section 103(a)(3)(c), formerly known as “limited scope.”

- Conforming modifications to the engagement letter, communications to those charged with governance, and management’s representation letter.

- New audit procedures related to audit risk assessment and response.

- Considerations related to the IRS Form 5500 filing.

The most significant change of SAS 136 is to the auditor’s opinion. After implementation of SAS 136, when management elects to have auditors exclude testing of certain investment information prepared and certified by a qualified institution as described in 29 CFR 2520.103-8, this will no longer constitute a scope limitation and thus eliminates the disclaimer of opinion.

The Auditor's Responsibility for "Other Information"

Many organizations issue annual reports that include other information, defined as financial and non-financial information other than financial statements and the auditor’s report. When other information is included in an annual report and the annual report is available before the auditor’s report is issued, the auditor’s report is required to include an “Other Information” section. This section is required to detail management’s and the auditor’s responsibility regarding the other information included in the annual report and a statement that the auditor’s opinion does not cover the other information. The new standard defines “annual report” and provides examples of reports which do not meet the definition, such as IRS Forms 990 and 5500.

The Call for Increased Communications

As a result of the changes to the auditor’s report under SAS 134 and 136, changes will have to be made to audit engagement letters, communications with those charged with governance, and management’s representation letter. Auditors will be required to communicate to those charged with governance any significant risks identified when planning the audit and any expected modifications to the auditor’s report. Worth mentioning is that several amendments were made to direct the auditor’s attention to the notes on the financial statements throughout the audit process.

As we gear up for adoption, take the time to carefully review and effectively implement these auditing standards changes to ensure that we all uphold the integrity of the profession and the quality of the audit process.