Evaluating the CPA License: What’s the True Value?

While taking and passing the CPA exam is a major challenge, the work that goes into the license offers rewards for a lifetime.

By Barry R. Palatnik, Ed.D., CPA, and Jean Ingersoll Abbott, Ed.D., CPA | Digital Exclusive - 2020

Students often ask, “Do I really need a CPA license?” The obvious answer is that a CPA license is needed to perform financial statement audits and reviews. But not all students are interested in auditing. How will a CPA license

enhance their accounting career?

The National Association of State Boards of Accountancy (NASBA) lists the following five reasons to obtain a CPA license:

- Prestige and respect

- Career development

- Career security

- Job satisfaction

- Money and benefits

Prestige and Respect

CPAs are members of an elite group of financial professionals. There are approximately 1.3 million accountants in the United States and approximately half of them—664,532—are CPAs. The American Institute of CPAs (AICPA) noted in

a 2016 report, “When most people think about a strong brand, Disney or Apple come to mind. But when we at the AICPA think of a strong brand, we think of the CPA. And we are pleased again to report that independent research

confirms that the CPA stands stronger than ever.”

The CPA brand is supported by the three attributes of licensing: education, examination, and experience. For most candidates, the biggest obstacle is the Uniform CPA Examination (CPA exam). While we never hear a student say they are looking forward

to taking the exam and have never known a licensed CPA willing to take it again, the work that goes into passing the exam can offer rewards for a lifetime.

Career Development

The CPA profession continues to be at the forefront of business transformation. In its “2019 Trends”

report,

the AICPA stated that the accounting profession is rapidly evolving, driven by data science and analytics, changing the way the CPA is doing business. The profession responds to the dynamic business and technology environment by keeping the CPA exam relevant

and by requiring CPAs to engage in continuing professional education. The CPA exam is frequently refreshed and aims to test the higher-order skills that the profession requires of newly licensed CPA.

The CPA profession is proactive in guarding and enhancing the value of the CPA license. In December 2019, the AICPA and NASBA introduced a proposal for a “New Model for CPA Licensure.” The model uses a “core and disciplines”

approach. The proposed CPA exam will test a core of knowledge in accounting, auditing, tax and technology, and candidates will select one discipline for further testing, such as tax, business reporting or information systems. This proposal is currently

in its comment phase; the AICPA anticipates finalizing the approach for an updated CPA licensure model in summer 2020. The implementation is expected to be a multi-year effort.

Career Security

The U.S. Bureau of Labor Statistics expects a 6-percent job growth rate for auditors and accountants from 2018 to 2028, in line with average job growth expectations. But they state that, “Accountants and auditors who have earned professional recognition,

especially as Certified Public Accountants (CPAs), should have the best prospects.”

Decision makers and stakeholders have a growing need for nonfinancial information. The CPA profession is in the position to step in and fill this need. According to

a 2018 report on

the future of the accounting profession by Ovidius University, “People trust the accountancy profession just as they trust in doctors, even more the CPA is viewed with greater confidence in comparison with professions such as journalist, lawyer

or politician, which shows that the accounting profession benefits from trust from the population.” There is ample evidence that the CPA has the skill set to add value to businesses.

Job Satisfaction

CPAs have great job flexibility. Many start careers at public accounting firms, but there are other options. Businesses, nonprofits and governments all need accountants, and the CPA license enhances the careers of those who specialize in management accounting.

The Institute of Management Accountants’ 2019 Global

Salary Survey found that, in the United States, those with a CPA and Certified Management

Accountant (CMA) credential made approximately 15 percent more than those with a CMA only. CPAs also have the option of starting their own firm and specializing in an area of interest. Job flexibility allows the CPA to tailor work to their lifestyle and

life stage.

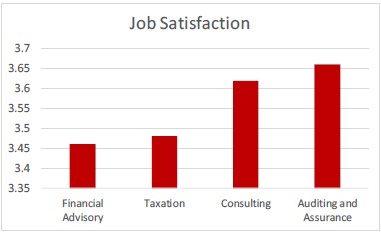

Public accounting firms, with their wide variety of services, can offer satisfying careers and opportunity for advancement. A

2016 survey in

the Journal of Accountancy showed what areas of public accounting had the happiest employees. The survey used a five-point scale; a score of five indicated the happiest employees. Auditing and assurance employees were the happiest, financial advisory

the least happy, with taxation and consulting in the middle.

To maintain job satisfaction, public accounting firms must be proactive. Firm leadership should be flexible in creating work/life balance for their CPAs. Compensation packages should not be overlooked to retain top talent. Young CPAs should be

mentored for leadership positions and given the opportunities to learn about the different services offered.

Money and Benefits

According to the U.S. Bureau of Labor Statistics, the median salary for accountants and auditors in 2018 was $70,500. Keep in mind that there are many factors that contribute to salaries, including geographic locations and size of employer. Accounting

graduates who passed the CPA exam with one year of experience can earn, on average, between $46,000 and $68,000, again depending on the geographic location and size of the firm. Without the CPA license, earnings drop to between $44,000 and $60,000.

Putting it into accounting terminology, one approach is to use the net present value method to evaluate the CPA license as an investment. In a 2016 Journal of Accountancy

article, the authors used a conservative approach, considering all the expenses of acquiring and maintaining a CPA license. They found that the net present value of the license when obtained right after college graduation,

over a 37-year career at a small firm, is approximately $130,000. This value increases for those working at a large firm. Based on both research and anecdotal evidence, accounting students have a high probability of receiving a satisfying return on their

investment and having respected, challenging, and flexible careers.

Barry R. Palatnik, CPA, Ed.D., MBA, is assistant professor of accounting at Stockton University. He can be reached at [email protected]. Jean Ingersoll Abbott, CPA, Ed.D., MBA, CIRA, CDBV, is associate professor of business studies in accounting at Stockton University. She is a member of the NJCPA Student Loan Debt Task Force and can be reached at [email protected].

Reprinted with permission of the New Jersey Society of CPAs from the May/June 2020 issue of

New Jersey CPA magazine.